Numbers rule supreme in the intricate world of finance. Mathematics is essential in understanding and making educated financial decisions, from calculating interest rates to managing assets. Financial mathematics, a branch of applied mathematics, provides the tools and techniques necessary for analysing and solving financial problems.

The Time Value of Money

The time value of money is a fundamental topic in financial mathematics. Money can expand over time owing to interest and investment returns. In contrast, its value depreciates with time owing to inflation. Understanding how the value of money varies over time is critical for sound financial planning and decision-making.

Interest and Compound Interest

Interest is a fundamental component of financial mathematics. It represents the cost of borrowing money or the return on invested capital. There are two primary types of interest: simple interest and compound interest. Simple interest is calculated based on the initial principal amount, while compound interest takes into account both the principal and accumulated interest over time. Compound interest is the more common and powerful form of interest, as it allows money to grow exponentially over time.

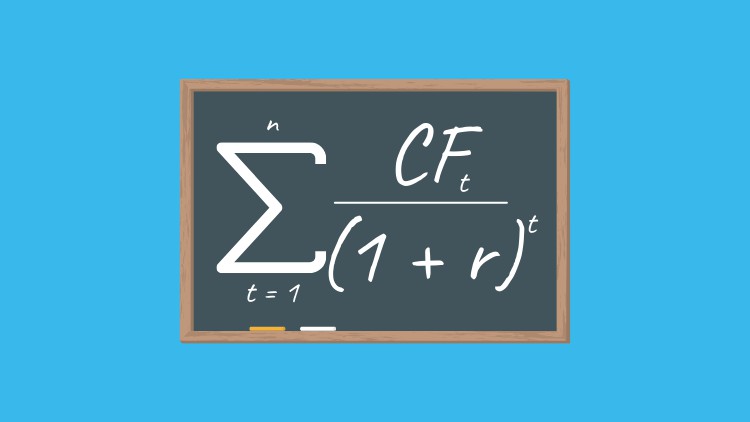

Present Value and Future Value

Another important concept in financial mathematics is present value and future value. Present value refers to the current worth of a future sum of money, while future value represents the value of an investment or sum of money at a future date. Present value calculations allow individuals and businesses to assess the desirability of potential investments by considering the time value of money. These calculations take into account the future cash flows, the discount rate, and the time period to determine the present value of an investment.

Risk and Return

Financial mathematics also provides tools for analysing risk and return. The concept of risk involves measuring the uncertainty and potential loss associated with an investment. Return, on the other hand, measures the gain or profit generated by an investment. By evaluating risk and return, investors can make informed decisions about the trade-offs between potential rewards and possible losses.

Applications in Portfolio Management, Option Pricing, and Risk Management

Aside from these principles, financial mathematics is important in portfolio management, option pricing, and risk management. Portfolio management entails optimising investment allocation to meet a desired risk and return profile. Option pricing methods, such as the Black-Scholes model, calculate the fair value of financial derivatives using mathematical procedures. Value at Risk (VaR) is a risk management strategy that uses mathematical models to assess and control possible losses in financial portfolios.

Finally, financial mathematics is an essential science for comprehending the complicated world of finance. Its principles and strategies let people and organisations make sound investment decisions, manage risk, and prepare for the future. Individuals may obtain a better grasp of how money works and utilise that knowledge to attain their financial objectives by learning the principles of financial mathematics.